The 5 Best Digital Trading Journals for 2026

Disclaimer

Some links may earn us a small commission at no extra cost to you.

Click here to read our full affiliate disclosure.

Disclaimer

We believe in complete transparency with our audience.

Some links may earn us a small commission at no extra cost to you.

Please know that we only recommend products/services we have personally used, thoroughly researched, and genuinely believe can benefit our audience.

We are immensely grateful for every click and purchase you make through these links. Thank you for being a part of our community and for your continued support!

Click here to read our full affiliate disclosure.

Let's be honest: most forex traders lose money.

Not because they lack intelligence. Not because they picked the wrong strategy. They lose because they keep making the same mistakes over and over again without even realising it.

That's where a digital forex trading journal changes everything.

This tool distinguishes serious traders from those who just gamble repeatedly.

When used correctly, it makes you confront the reality of your trading activities. It shows you the good aspects, the bad aspects, and the unpleasant patterns that you would prefer to overlook.

In this guide, I'll walk you through the five best forex trading journals available today. Each one serves a different type of trader, and I'll help you figure out which one fits your goals.

Let's dive in.

Why You Actually Need a Trading Journal

Here's what most beginners don't understand: your memory lies to you.

You'll remember that one amazing trade you sniped perfectly. You'll forget the three impulsive revenge trades that wiped out your week's profits.

A trading journal shows all your history, trade by trade, decision by decision.

What a Good Journal Does

The right journal tracks more than just wins and losses. It reveals:

Your actual edge (not the one you think you have)

Recurring emotional patterns that sabotage your account

Which setups actually make you money (versus the ones that feel exciting)

Risk management leaks that slowly drain your capital

Think of it like a fitness tracker for traders. You can't improve what you don't measure.

The 5 Best Digital Trading Journals (Ranked by Use Case)

Not all journaling software is created equal. Some excel at analysing cold hard data. Others focus on psychology and discipline.

Here's the breakdown.

1. Forex Tester – Best for Integrated Backtesting and Trade Journaling

Image Source: Forex Tester Website

Forex Tester is the go-to platform for traders who want backtesting and journaling in one place.

If you've spent some time learning how to trade properly, you've probably heard of Forex Tester. Traders use it to practice their strategies with historical data, check their edge, and develop actual skills before risking real money.

Why Forex Traders Love Forex Tester

The biggest selling point? Seamless integration between backtesting and journaling.

You practice trades on historical data, and Forex Tester automatically journals every single one. No need for copy-pasting. No chance of forgetting to log trades.

Here's what you get:

Automatic trade logging during backtesting sessions

Deep performance statistics (win rate, profit factor, average trade duration)

Drawdown tracking that shows exactly when you're bleeding money

Equity curve visualisation that reveals your true consistency

AI-powered feedback that reviews your backtests and suggests improvements

Forex Tester is popular among traders who want to develop their edge risk-free. It's the platform serious traders use when they're tired of blowing accounts and want to build proven skills first.

Strengths:

Fully automated journaling – practice and log simultaneously

Excellent statistical depth for individuals who love analysing data

Great for long-term skill development across months or years

Works with historical data from any currency pair

Limitations

Here's the catch: Forex Tester is built for practice, not live tracking.

Focused on backtesting – you'll need another tool for live trade journaling

Minimal real-time broker integration – built for simulation, not live account monitoring

Can overwhelm beginners as they become lost in too much data.

Best For:

Forex traders obsessed with skill development

Traders who want to prove their strategy works before going live

Anyone building transparent, verifiable performance records from practice

Bottom line: Forex Tester is outstanding for developing and testing strategies risk-free. However, you'll need a separate solution for journaling your live trades. Pair it with a live journaling tool for maximum impact.

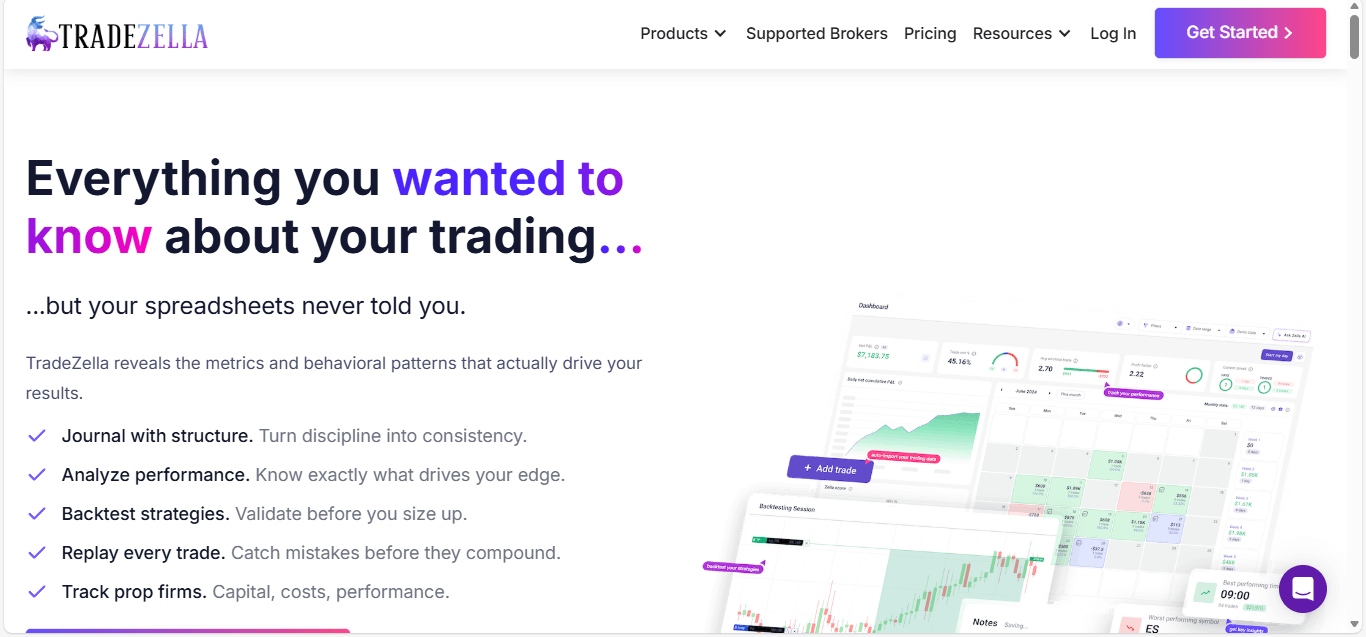

2. TradeZella – Best for Visual Analytics and Trade Review

Image Source: TradeZella Website

TradeZella is a great journal for visual learners who want insights fast.

The platform has exploded in popularity because it makes reviewing trades genuinely enjoyable. The interface is clean, modern, and designed to help you spot patterns at a glance.

Why Traders Choose TradeZella

TradeZella's superpower is visual clarity.

You're not staring at spreadsheets trying to decipher what went wrong. Everything is presented in intuitive dashboards that highlight your strengths and weaknesses.

Key features include:

Automatic broker syncing (no manual entry required)

Clean, modern dashboards that don't require a genius to understand them

Advanced performance breakdowns by setup type, time of day, currency pair

Trade replay and screenshot support to review exactly what you saw

Setup-based analytics that show which patterns actually work for you

TradeZella excels at helping you see your behaviour clearly. It's like having a coach who points out exactly where you keep messing up.

Strengths:

Extremely user-friendly interface – beginners get it immediately

Strong visual analytics – charts and graphs that actually make sense

Easy trade filtering and tagging to isolate specific strategies

Excellent for spotting recurring mistakes you didn't know you had

Limitations:

All features require payment (there's no free tier)

Best used alongside written reflection for emotional awareness

Best For:

Active traders making multiple trades per week

Visual learners who need to see the problem

Traders focused on execution improvement and pattern recognition

Bottom line: TradeZella is perfect if you want clear visual insight into what's actually driving your results. It won't dig deep into your emotional triggers, but it'll show you exactly where your edge is.

3. Edgewonk – Best for Serious Traders Focused on Self-Improvement

Image Source: Edgewonk Website

Edgewonk is not designed for casual traders.

This platform is built for traders who treat forex like a business, not a hobby. It emphasises psychology, discipline, and long-term improvement over surface-level stats.

Why Traders Choose Edgewonk

Edgewonk pushes you to ask hard questions about your behaviour.

It's not enough to know you lost money. Edgewonk wants to know why. Were you following your rules? Did you size correctly? Were you revenge trading?

Here's what makes it different:

Advanced trade tagging to categorise by emotion, setup, and market condition

Expectancy and performance metrics that reveal your true edge

Psychological scoring to track mental state before/during/after trades

Deep strategy analysis to compare different approaches

Structured review workflows that force consistent self-evaluation

This isn't a platform that lets you off easy. It's designed for traders committed to getting better.

Strengths:

Strong psychology focus – treats mindset as seriously as metrics

Excellent performance metrics for statistical analysis

Designed for continuous improvement with built-in review processes

Highly customizable to match your trading style

Limitations:

Paid platform with no free tier

Can feel complex for beginners who aren't ready for deep analysis

Best For:

Intermediate to advanced traders ready to level up

Traders serious about long-term growth and mastery

Anyone refining their system and working on discipline

Bottom line: Edgewonk rewards discipline and honesty. If you're ready to do the work, it's one of the most powerful trading journal apps available.

4. TraderSync – Best Balance of Simplicity and Analytics

Image Source: TraderSync Website

TraderSync provides a combination of simplicity and sophistication.

It maintains a balance between usability and depth, which makes it suitable for traders who desire structured journaling but don’t want to deal with excessive features.

Why Forex Traders Use TraderSync

TraderSync is user-friendly, especially for growing traders who've moved past demo accounts but aren't ready for ultra-advanced platforms yet.

Here's what you get:

Automatic trade imports from major brokers

Clean performance dashboards that highlight key metrics

Easy tagging and screenshots for trade documentation

Deep strategy analysis to compare different approaches

Solid risk and expectancy metrics without data overload

It's a platform you can start using immediately without watching multiple tutorials.

Strengths:

Beginner-friendly interface – intuitive from day one

Experience good analytics without feeling overloaded – just enough data to be useful

Cloud-based and accessible from anywhere

Limitations:

Some advanced features are behind higher paid plans (though pricing is reasonable)

Psychology tracking is lighter than Edgewonk's approach

Best For:

Beginners transitioning to consistent live trading

Traders who want clarity and structure without complexity

Anyone avoiding overly technical platforms

Bottom line: TraderSync is ideal if you want order, simplicity, and steady improvement. It does not offer an extensive number of features, but just enough so it doesn’t create confusion.

5. Notion-Based Trading Journals – Best for Psychology & Discipline

Image Source: Notion Website

Here's a curveball: not all digital trading journals are specialised apps.

Many disciplined traders use Notion-based trading journals. These are custom systems built entirely around reflection, process, and accountability.

Why Traders Use Notion Journals

Notion doesn't auto-import trades or calculate your Sharpe ratio. So why do traders love it?

Because it excels at the one thing most platforms ignore: behavioural awareness.

With Notion, you build the exact kind of journal you need.

Here's what you get:

Fully customizable layouts – design it however makes sense to you

Strong focus on mindset and rules – journaling prompts for mental state

Combines planning, journaling, and review in one workspace

Encourages intentional thinking before and after every trade

While Notion won't crunch your performance numbers automatically, it forces you to slow down and think about why you're trading.

Strengths:

Excellent for psychology and discipline – makes you confront emotional patterns

Highly flexible – build the exact system you want

Clean and distraction-free – no flashy charts that divert your attention

Strong habit-building tool for developing trading routines

Limitations:

Manual data entry – you're logging trades yourself

No automated analytics – need to calculate metrics manually or use formulas

Requires initial setup – not plug-and-play like other options, unless you use a Trading Journal Notion Template

Best For:

Beginners focused on building discipline first

Traders working on emotional control and rule-following

Anyone who values process over statistics

Bottom line: Notion journals build the mental foundation required for long-term consistency. If you're struggling with impulsive trades or rule-breaking, this approach might be exactly what you need.

How to Actually Use a Trading Journal

A journal only works if you use it intentionally. Here's how to make it count.

Step 1: Journal Every Single Trade (No Exceptions)

Incomplete data creates false conclusions.

If you only log winning trades (or only losing trades), your journal becomes useless. You need the full picture (every entry, every exit, every mistake).

Step 2: Judge Process, Not Profit

Stop obsessing over whether a trade made money.

Ask better questions:

Did I follow my trading plan?

Did I manage risk according to my rules?

Was my entry based on my strategy or emotion?

A winning trade that broke your rules is a failure. A losing trade that followed your plan perfectly is a success.

Related Blog Post: Master 10 Risk Management Rules (Survive Trading Long-Term)

Step 3: Review Weekly, Not Emotionally

Daily emotional reviews can often result in overreacting.

You'll panic after one bad day and change everything. Or you'll get overconfident after a winning streak and blow your account.

Set a weekly review time. Look at patterns over 20+ trades, not individual outcomes.

Step 4: Improve One Behaviour at a Time

Consistency is built gradually, not overnight.

Don't try to fix everything at once. Pick one issue (maybe you're entering late on breakouts, or you're risking too much on Fridays) and focus on that for a month.

Small, incremental improvements compound into massive gains.

Common Mistakes Traders Make with Journals

Avoid these traps that can kill your progress.

Obsessing over win rate: A 40% win rate with a 1:3 risk-reward ratio crushes a 70% win rate with 1:1 targets. Focus on expectancy, not batting average.

Ignoring emotional patterns: You can't improve what you don't acknowledge. If you're always revenge trading after losses, your journal needs to track that.

Strategy-hopping: Switching trading systems every week because of short-term results. Your journal should show you whether your edge needs time to play out.

Using stats to justify bad habits: "My win rate is 60%, so my strategy works!" Meanwhile, your average winner is $50, and your average loser is $200.

Treating journaling as optional: If you skip journaling when you're busy or tired, you'll miss the exact moments where you make your worst decisions.

Why Trading Journals Filter Out Gamblers

Here's something most traders don't realise: gamblers hate journaling.

Why? Because journals:

Remove excuses and rationalisations

Expose impulsive, emotional behaviour

Demand accountability for every decision

Make it impossible to lie about results

Serious traders embrace this. They want to see their mistakes clearly so they can fix them.

That's why journaling is one of the strongest self-selection filters in trading. The moment you commit to honest journaling, you're already ahead of 90% of retail traders.

Final Thoughts: Journals Don't Make You Profitable, They Make You Honest

Forex trading doesn't reward hope, excitement, or hunches.

It rewards:

Consistent risk control

Unwavering discipline

Repetition of proven behaviours

Digital trading journals exist to support that process.

They won't make you rich overnight.

But they can make you consistent. They can help you see your blind spots. They can turn random trades into a repeatable system.

And in trading, consistency is everything.

Ready to start tracking your trades properly? Pick one of these journals, commit to using it for at least three months, and watch how fast your trading transforms when you finally see the truth about your performance.

Trending

It's possible, even without an SSN.

Discover key qualities to consider when choosing right.

Learn what contributes to a successful business launch.

Deals & Promotions

You can also gain unlimited free access to Exclusive Content and Offers.

2026 © MitchelleO.D. All Rights Reserved.

Disclaimer: As an Amazon Associate, we earn from qualifying purchases. We may participate in additional affiliate networks or programs beyond Amazon.

Visit our Affiliate Disclosure Page to learn more.