The Best Forex Trading Brokers

Disclaimer

Some links may earn us a small commission at no extra cost to you.

Click here to read our full affiliate disclosure.

Disclaimer

We believe in complete transparency with our audience.

Some links may earn us a small commission at no extra cost to you.

Please know that we only recommend products/services we have personally used, thoroughly researched, and genuinely believe can benefit our audience.

We are immensely grateful for every click and purchase you make through these links. Thank you for being a part of our community and for your continued support!

Click here to read our full affiliate disclosure.

Updated on 18/10/2025

Brokers serve as "middlemen", enabling your entry into the market, and providing a range of tools, platforms, and resources to support you throughout your trading journey.

Choosing the right broker can make all the difference between successful trading and a costly learning experience.

What Makes a Good Forex and CFD Broker?

With so many brokers competing for your attention, how can you tell the difference between the good and the bad?

Here are the key qualities to consider when choosing the right broker:

1. Regulation and Security

Ensure your broker is regulated by a reputable authority.

They enforce strict standards and rules that brokers must adhere to, providing peace of mind that your funds are in safe hands.

2. Trading Costs

Trading costs can have a substantial impact on your profitability.

Keep an eye on the spread (the difference between the bid and ask prices); narrower spreads mean lower costs.

Brokers who promote "no commissions" yet compensate with wider spreads should be avoided.

3. Trading Platforms and Tools

A broker should provide you with access to user-friendly, stable, and technologically advanced trading platforms.

Additionally, it provides a mixture of tools and resources to help you improve your trading, such as educational materials, market analysis, and risk management tools.

4. Asset Selection

Trading is not just about the forex market; it also involves trading various assets like commodities, indices, and cryptocurrencies.

A good broker should offer a range of assets to diversify your portfolio and explore new trading opportunities.

5. Customer Support

Effective customer support is critical. You may encounter technical difficulties, need assistance with deposits or withdrawals, or have questions about your trades.

A responsive and knowledgeable customer support team can be lifesaving in these situations.

6. Execution Speed and Reliability

When trading, every second counts. A good broker ensures quick order execution and minimal slippage, so your trades are executed at the desired prices.

Look for a broker with a reputation for reliability and minimal downtime.

7. Account Types and Minimum Deposits

A good Forex broker offers various account types to cater to different traders, from beginners to experienced professionals.

Ensure they have an account type that suits your trading style and budget.

Beware of brokers with excessive minimum deposit requirements, especially if you're just starting.

8. Transparency and Fees

Make sure that you’re aware of all of the fees associated with your chosen broker.

These may include overnight financing charges (swap rates), inactivity fees, and withdrawal fees.

A good broker is transparent about these costs, ensuring you're fully aware of the expenses you'll incur.

Choosing the Best Forex and CFD Trading Broker:

Here are the options.

You may use the buttons above to skip through to your region.

For the USA

I. Tastyfx

Image Source: Tastyfx Website

IG, a prominent Forex trading broker founded in 1974, is known for its strong regulatory compliance and excellent user experience.

In June 2024, IG launched tastyfx – a new separate brand designed specifically for U.S. traders.

Tastyfx caters to traders of various experience levels, offering a selection of trading platforms to suit different needs, low spreads, and fast executions.

Pros of Using Tastyfx for Trading:

1. Strong Regulatory Compliance:

Tastyfx is regulated by respected authorities such as the FCA (Financial Conduct Authority), FMA (Financial Markets Authority), and six other Tier-1 jurisdictions.

This regulatory oversight ensures that the broker is trustworthy and adheres to strict financial standards and practices.

2. Wide Range of Markets and Instruments:

Tastyfx offers a variety of trading assets, including 97 currency pairs and over 19000 tradeable symbols. Traders can choose assets that align best with their trading strategies and risk tolerance.

Image Source: Tastyfx Website

3. Extensive Educational Materials:

Award-winning research content and a broad range of educational resources make tastyfx great for beginners and experienced traders.

Cons of Tastyfx:

1. No Copy Trading:

Tastyfx falls short if you’re a trader looking to copy signals from other investors or leverage your own strategies.

2. MetaTrader 5 (MT5) Not Available:

Although tastyfx offers several trading platforms, including MetaTrader 4 and TradingView, MT5, which has more advanced features than MT4, is not supported.

II. Plus500 US

Image Source: Plus500 US Website

Plus500 US is a futures trading platform founded in 2021. It is part of Plus500 Ltd, a global financial services company operational since 2008.

Plus500 US offers traders access to various futures markets, including forex, cryptocurrencies, indices, and commodities, with a focus on ease of use, low commissions, and a user-friendly interface.

Pros of Using Plus500 US for Trading:

1. Strong Regulatory Compliance:

Plus500 US is regulated by respected authorities such as the CFTC (U.S. Commodity Futures Trading Commission), the NFA (National Futures Association), and other Tier-1 jurisdictions.

This regulatory oversight ensures the broker is trustworthy and adheres to strict financial standards and practices.

2. Low Fees:

Plus500 US charges no inactivity fees, live data fees, or platform fees. It also excels when it comes to commissions on futures contracts, making it an affordable option for traders.

3. Informative Educational Materials:

Plus500 US offers a range of educational resources, such as tutorial videos on The Futures Academy. This is great for traders looking to enhance their skills.

Image Source: Plus500 US Website

Cons of Plus500 US:

1. No Social Trading:

Plus500 US favours more experienced traders used to tackling the market on their own.

2. Basic Trading Tools:

Plus500 US offers a user-friendly proprietary platform. However, it lacks some of the more advanced technical analysis tools found in solutions like MT5.

Image Source: IG Website

Founded in 1974 as IG Index, IG is one of the most established Forex and CFD trading brokers.

It is known for its strong regulatory compliance, excellent all-round user experience, and innovation in trading.

IG is regulated by respected authorities such as the FCA (Financial Conduct Authority), FMA (Financial Markets Authority), and six other Tier-1 jurisdictions.

Pros of Using IG for Trading:

1. Wide Range of Assets:

There are over 17,000 tradable instruments available on IG, from forex and commodities to cryptocurrencies, and even weekend trading on popular indices like the DAX, which is uncommon and ideal for traders seeking extended market opportunities.

2. Extensive Educational Materials:

Award-winning research content and a broad range of educational resources make IG great for beginners and experienced traders.

Image Source: IG Website

3. Low Fees:

IG’s forex trading fees are competitive. It has many options for withdrawals and deposits and charges no fees for these transactions. Moreover, IG only charges inactivity fees after 2 years without trading.

Cons of IG:

1. No Copy Trading:

IG falls short if you’re a trader looking to copy signals from other investors or leverage your own strategies.

2. High Stock CFD Fees:

Trading fees for stock CFDs can be high compared to competitors.

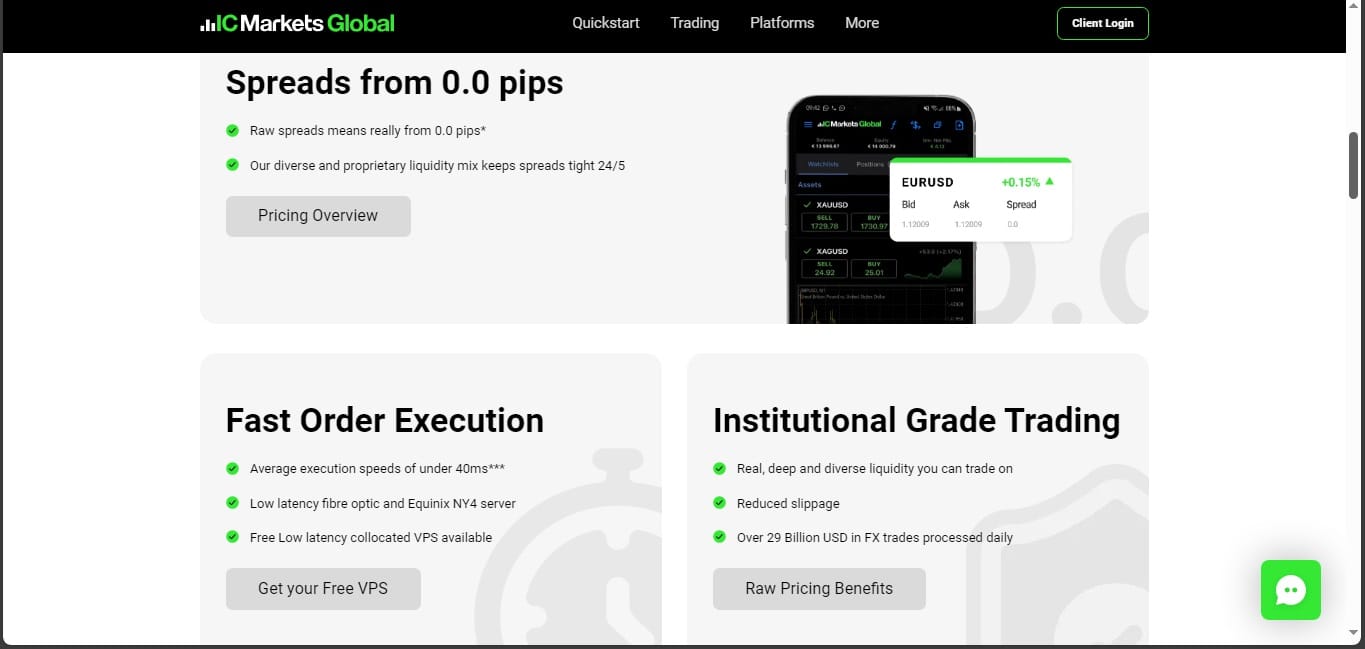

II. IC Markets

Image Source: IC Markets Website

IC Markets is an established forex and CFD broker. It was founded in 2007 and is headquartered in Sydney, Australia.

The broker is regulated by the ASIC (Australian Securities and Investments Commission) and the CySEC (Cyprus Securities and Exchange Commission).

IC Markets is particularly popular among professional traders due to its competitive spreads, low latency execution, and robust trading platforms.

Pros of Using IC Markets for Trading:

1. Multiple Trading Platforms:

IC Markets supports MetaTrader 4, MetaTrader 5, and cTrader, providing flexibility across trading environments.

You can access features like Expert Advisors, cBots for algorithmic trading, and backtesting tools through these platforms.

2. Low Fees and Tight Spreads:

IC Markets offers competitive spreads and trading fees. It has several options for withdrawals and deposits, and charges no fees for these transactions. This is great if you’re a high-volume or algorithmic trader.

Image Source: IC Markets Website

Cons of IC Markets:

1. Simple Educational Materials:

IC Market’s educational content is less extensive compared to some competitors. This can be a disadvantage for beginner traders.

2. High Financing Rates for CFDs:

Overnight fees or swap rates for CFDs can be higher compared to some competitors.

Image Source: FXPro Website

Founded in 2006, FXPro is a forex and CFD broker known for its advanced trading technology and extensive market access.

FXPro is regulated by several reputable financial authorities, including the FCA (Financial Conduct Authority) and the CySEC (Cyprus Securities and Exchange Commission).

FXPro offers access to a wide range of instruments such as forex, commodities, shares, indices, and futures, making it suitable for traders at various levels of expertise.

Pros of Using FXPro for Trading:

1. Multiple Trading Platforms:

FXProsupports MetaTrader 4, MetaTrader 5, cTrader, and its proprietary FXPro Edge app.

You can access features like Expert Advisors, cBots for algorithmic trading, and backtesting tools through these platforms.

2. Low Fees:

FXPro offers competitive spreads and low forex trading fees with no separate commissions. It has several options for withdrawals and deposits and charges no fees for these transactions.

This is an advantage for high-volume or algorithmic trader.

Image Source:FXPro Website

3. Extensive Educational Materials:

FXPro offers numerous educational resources for traders, making the broker a great option for beginners and experienced traders.

Cons of FXPro:

1. High Stock CFD Fees:

Trading fees for stock CFDs can be high compared to some competitors.

2. No Cent Accounts:

FXPro does not offer cent accounts, which are good for beginner traders looking to trade in actual markets with minimal risk.

For Africa

I. XM Group

Image Source: XM Website

XM Group is a multi-award winning forex and CFD broker, founded in 2009, with a strong focus on providing reliable trading services across various assets, including forex, cryptocurrencies, commodities, stocks, and indices.

XM Group is regulated by multiple entities depending on the region, including the CySEC (Cyprus Securities and Exchange Commission) for Europe, the ASIC (Australian Securities and Investments Commission) and FSCA (Financial Sector Conduct Authority) in South Africa.

Pros of Using XM Group for Trading:

1. Low Minimum Deposit:

You can start trading with as little as $5.

2. No Requotes:

XM Group guarantees that all your orders are executed at the price you set, without any delays or changes in the quoted price. This is particularly important for stop-loss orders.

Image Source:XM Website

3. Extensive Educational Materials:

XM Group offers numerous educational resources for traders, including videos, webinars and seminars, making the broker a great option for beginners and experienced traders.

Cons of XM Group:

1. Higher Fees on Some Accounts:

While the XM Zero account provides competitive spreads, other accounts may have slightly higher spreads compared to some competitors.

2. No Proprietary Trading Platform:

XM Group only supports MetaTrader 4 and 5 as trading platforms, which might be a problem for some traders.

II. Deriv

Image Source: Deriv Website

Deriv is a leading forex and CFD broker. The broker is a rebranded version of Binary, a platform founded in 1999.

It is regulated by multiple authorities, including the MFSA (Malta Financial Services Authority) and the VFSC (Vanuatu Financial Services Commission).

Deriv offers an extensive range of trading instruments including forex, commodities, cryptocurrencies, stocks, options and unique synthetic indices.

Pros of Using Deriv for Trading:

1. Low Minimum Deposit:

You can start trading with as little as $5.

2. Multiple Account Types and Trading Platforms:

Deriv caters to traders with different experience levels by offering diverse account types, including zero spread and swap-free accounts. It also supports multiple trading platforms, including the popular MetaTrader 5.

Image Source:Deriv Website

3. Flexible Transactions:

Deriv offers a wide range of deposit and withdrawal options and charges no transaction fees.

Cons of Deriv:

1. Limited Education and Research:

Deriv’s educational content is less extensive compared to some competitors. This can be a disadvantage for beginner traders.

2. Might Require Some Time to Explore:

The wide range of instruments and trading tools available on Deriv might take some getting used to, especially for new traders.

It’s important to learn and practice trading effectively on a demo account.

Final Thoughts

Take the time to assess which broker aligns best with your needs. Consider factors like your trading strategy, desired asset classes, risk tolerance, and trading experience.

As you begin your journey, also remember that acknowledging both the benefits and potential drawbacks of Forex trading is crucial.

Trading may not be suited to all investors due to the high level of risk involved.

Do not trade with money you cannot afford to lose because losing trades are inevitable, no matter how much research you have done or how positive you are in your trade.

Trending

It's possible, even without an SSN.

Discover key qualities to consider when choosing right.

Learn what contributes to a successful business launch.

Deals & Promotions

You can also gain unlimited free access to Exclusive Content and Offers.

2026 © MitchelleO.D. All Rights Reserved.

Disclaimer: As an Amazon Associate, we earn from qualifying purchases. We may participate in additional affiliate networks or programs beyond Amazon.

Visit our Affiliate Disclosure Page to learn more.