What Are Synthetic Indices and How Can You Trade Them?

Disclaimer

Some links may earn us a small commission at no extra cost to you.

Click here to read our full affiliate disclosure.

Disclaimer

We believe in complete transparency with our audience.

Some links may earn us a small commission at no extra cost to you.

Please know that we only recommend products/services we have personally used, thoroughly researched, and genuinely believe can benefit our audience.

We are immensely grateful for every click and purchase you make through these links. Thank you for being a part of our community and for your continued support!

Click here to read our full affiliate disclosure.

Updated on 04/10/2025

Trading has evolved significantly over the past few years, with more and more people seeking new ways to trade the markets beyond traditional stocks and forex. One of the more recent and exciting options is trading synthetic indices.

In this blog post, we’ll explain what synthetic indices are, why traders choose them, how you can trade them, and which brokers allow you to do so.

What Are Synthetic Indices?

At their core, synthetic indices are unique indices that mimic the behaviour of real-world markets but are not influenced by global news, economic events, or geopolitical factors.

Unlike traditional indices such as the S&P 500 or the Nasdaq, which reflect the performance of real companies or sectors, synthetic indices are unrelated to real-world assets.

Instead, they rely on a cryptographically secure random number generator that creates market-like conditions while maintaining a continuous trading environment.

So what exactly does this mean for traders?

Synthetic indices traders don’t have to worry about external market factors like inflation reports or unemployment rates.

They can focus entirely on technical analysis, price action, and strategy execution, rather than fundamentals or macroeconomic events.

Why Trade Synthetic Indices?

Synthetic indices are available for trading 24/7, 365 days a year because they’re not dependent on real exchanges, assets or time zones. You can trade:

Weekends

Public holidays

Late nights or early mornings

This flexibility makes synthetic indices especially attractive for traders who:

Have full-time jobs

Prefer trading outside standard market hours

Want consistent market conditions year-round

Where Can You Trade Synthetic Indices?

Deriv (formerly Binary) is one of the earliest brokers to introduce synthetic indices to retail traders. It is well-known for its wide range of synthetic instruments and multiple trading platforms.

Deriv Logo

Weltrade also offers synthetic indices through a dedicated SyntX account, available exclusively on MetaTrader 5 (MT5). Weltrade’s SyntX instruments are categorised based on behavioural market models

Weltrade Logo

The Different Types of Synthetic Indices

One of the most exciting parts of trading synthetic indices is the variety of options available. Let’s break them down:

Volatility Indices (Deriv)

Volatility indices simulate varying levels of market volatility. These include Volatility 10, 25, 50, 75, and 100 Indices, with higher numbers representing higher volatility.

FX Vol / SFX Vol (Weltrade)

Also simulate forex-like volatility, with SFX Vol including scheduled spike behaviour.

Crash and Boom Indices (Deriv)

Crash and Boom Indices mimic markets experiencing sudden downward (Crash) or upward (Boom) price movements. They can also offer opportunities to trade long-term declines or upward trends.

PainX and GainX (Weltrade)

Similar to Crash and Boom, PainX and GainX indices simulate gradual movement in one direction, followed by sharp reversals.

Range Break Indices (Deriv)

These indices move when prices break out of a set range. Traders who prefer predictable movements often choose Range Break Indices, since you can apply breakout strategies to them.

BreakX (Weltrade)

Similar to Range Break indices, these instruments change behaviour after breakouts occur.

Step Indices (Deriv)

Step Indices move in fixed steps, usually between 0.1 and 0.5. This steady and predictable movement makes them an excellent choice for traders who prefer lower-risk and more consistent trades.

Jump Indices (Deriv)

Jump Indices simulate markets with sudden price jumps. The jumps can happen at varying intervals and intensities. These indices offer different levels of volatility, from 10% to 100%.

SwitchX (Weltrade)

Similar to Jump indices, these instruments change behaviour after jumps occur.

TrendX (Weltrade)

These instruments adapt based on recent price behaviour to create trend persistence.

FlipX (Weltrade)

Each price move has a 50/50 chance of moving up or down

Image Source: Weltrade

Pros and Cons of Trading Each Type of Synthetic Index

With so many different types of synthetic indices, it's important to weigh their benefits and drawbacks:

Volatility and FX Vol / SFX Vol Indices:

• Pro: High liquidity, constant market availability, and fast-paced trading opportunities.

• Con: High risk due to volatility. This may overwhelm beginner traders.

Crash & Boom and PainX & GainX Indices:

• Pro: Excellent for capturing big market moves, allowing trend traders to capitalise on sudden shifts.

• Con: Requires constant monitoring due to sharp market reversals that can lead to losses if you're unprepared.

Range Break and BreakX Indices:

• Pro: Predictable breakout patterns, ideal for traders with breakout strategies.

• Con: Price movements can be slow, making profit potential lower than in highly volatile markets.

Step Indices:

• Pro: Fixed step movements make these indices easier to manage, with reduced risk compared to high-volatility indices.

• Con: The predictability of movement can also limit profit potential for traders seeking fast, large price changes.

Jump and SwitchX Indices:

• Pro: Markets with sudden jumps offer opportunities for quick profits.

• Con: The unpredictable nature of jumps can make it difficult to manage risk, and traders need to be vigilant.

Accounts That Support Synthetic Indices Trading

When trading, choosing the right account type can make all the difference when implementing your strategies. Deriv offers these account options for synthetic indices trading:

Deriv MT5 Swap-Free Account

This account is perfect for traders who want to avoid swap charges (interest fees on overnight positions).

It’s a great choice for traders who prefer holding their positions for long periods and don’t want to suffer additional costs.

Deriv MT5 Zero Spread Account

The Zero Spread account is ideal for those who want to minimise trading costs, especially during high-volume trading.

By removing the spread, you get tighter price movements, which can be an advantage for precision trading.

Deriv MT5 Standard Account

The Standard Account is a versatile option for many traders. It offers a balance of trading conditions that caters to various trading styles.

Image Source: Deriv Website

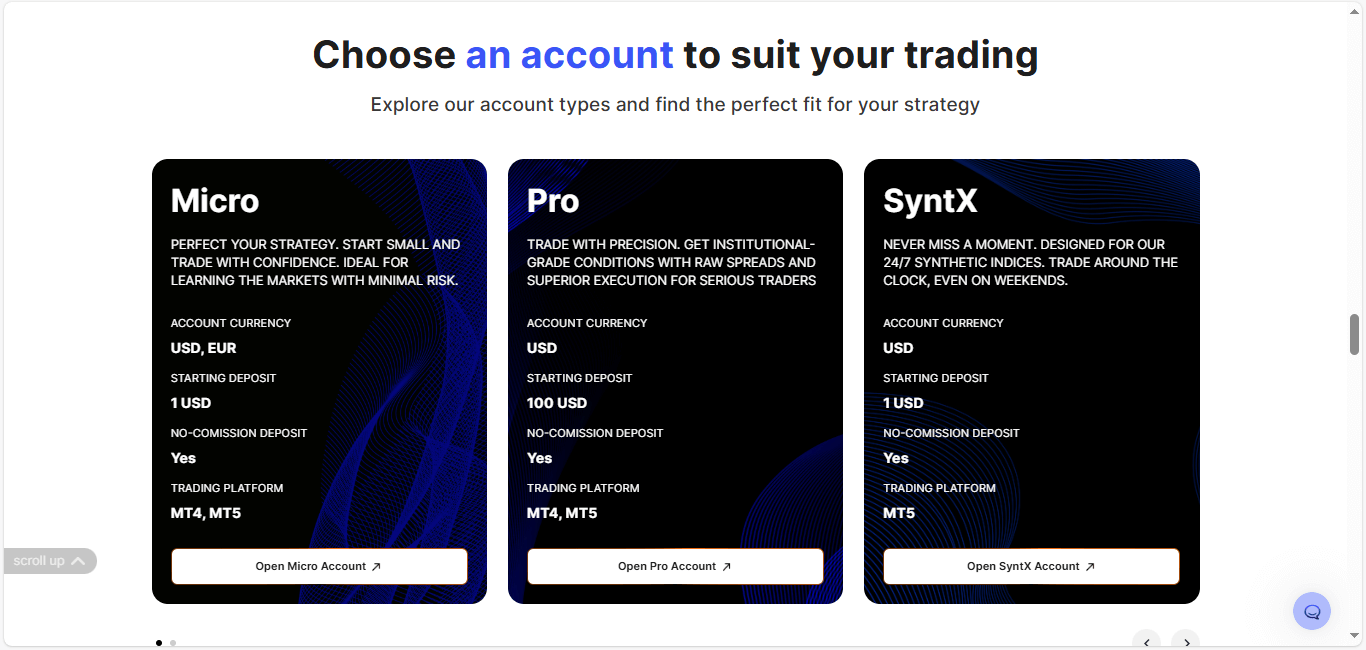

Weltrade offers synthetic indices trading via the SyntX Account. It's available on MT5 only, allows low minimum deposits and supports automated trading and EAs.

Image Source: Weltrade

Each account type caters to different trading styles. Choose one that aligns with your strategy and financial goals. And please remember that it’s important to practice and get a feel for how synthetic indices behave before jumping into live trading.

NOTE: Deriv synthetic indices trading is not available to traders living in the USA, Canada, the United Arab Emirates (UAE), and Singapore.

NOTE: Weltrade synthetic indices trading is not available to traders living in the USA, Canada, the EU, Belarus, Russia and other non-supported (restricted) countries.

Image Source: Weltrade

For traders seeking more comprehensive analyses, Deriv and Weltrade integrate with TradingView, the best web-based charting and analysis tool for trading.

Final Thoughts

Synthetic indices present an exciting, unique trading experience.

However, while these indices can provide more opportunities to generate profits from the market, remember their potential drawbacks.

Trading may not be suited to all investors due to the high level of risk involved.

Do not trade with money you cannot afford to lose because losing trades are inevitable, no matter how much research you have done or how positive you are in your trade.

Trending

It's possible, even without an SSN.

Discover key qualities to consider when choosing right.

Learn what contributes to a successful business launch.

Deals & Promotions

You can also gain unlimited free access to Exclusive Content and Offers.

2026 © MitchelleO.D. All Rights Reserved.

Disclaimer: As an Amazon Associate, we earn from qualifying purchases. We may participate in additional affiliate networks or programs beyond Amazon.

Visit our Affiliate Disclosure Page to learn more.