The 7 Best Trading Tools for Beginners: What You Actually Need

Disclaimer

Some links may earn us a small commission at no extra cost to you.

Click here to read our full affiliate disclosure.

Disclaimer

We believe in complete transparency with our audience.

Some links may earn us a small commission at no extra cost to you.

Please know that we only recommend products/services we have personally used, thoroughly researched, and genuinely believe can benefit our audience.

We are immensely grateful for every click and purchase you make through these links. Thank you for being a part of our community and for your continued support!

Click here to read our full affiliate disclosure.

Here's what nobody mentions when you first start trading:

The initial challenge you’ll encounter isn’t finding the right strategy. It won't even be learning how to manage your emotions (though that comes close).

Your first real challenge? Choosing among the overwhelming number of tools available.

Every corner of the internet is screaming at you to buy more stuff. More indicators. More software. More screens. More paid subscriptions that promise to make you rich overnight.

Charts that look like abstract art, trying to pass as data. Telegram groups selling "90% accuracy signals”. Trading bots marketed as your ticket to passive income.

And you know what professional traders figured out years ago?

None of that stuff makes you profitable.

Discipline makes you profitable. Clear thinking makes you profitable. Risk management makes you profitable.

The best trading tools for beginners don't replace good decisions; they support them.

So, let's cut through the noise. I'm going to show you exactly what you need at the beginning of your trading journey, and why each tool matters. I’ll also highlight the costly options you should definitely steer clear of.

If you're serious about learning how to trade (not gamble), this guide will save you thousands of dollars and months of frustration.

Why Most Trading Tools Are Designed to Fail You

Before we dive into the actual list, you need to understand something critical.

No trading tool on earth will:

Predict the market perfectly

Eliminate your losses

Guarantee profits

Zero. None.

Every legitimate tool exists for one reason: to help you make better decisions and execute them consistently.

The best beginner trading tools share three qualities:

Simplicity. You understand how they work.

Transparency. No black boxes or secret formulas.

Educational value. They teach you something about the market or yourself.

Keep that framework in mind as we go through this list.

The 7 Essential Trading Tools Every Beginner Actually Needs

1. A Regulated Broker + Trading Platform

Your broker is literally your gateway to the markets. No broker, no trades. Pretty simple.

But here's where beginners mess up: they choose brokers based on flashy marketing instead of the boring yet critical fundamentals.

Common platforms you'll see:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

cTrader

Various broker proprietary platforms

What matters when choosing forex trading platforms for beginners?

Safety first. Is your money protected? Is the broker regulated by a legitimate authority (FCA, ASIC, CFTC)?

Execution quality. Can you get in and out of trades without slippage eating you alive?

Ease of use. Can you set a stop-loss without needing a PhD?

What doesn't matter? Crazy high leverage. Unrealistic bonuses. Dashboards that look like Mission Control during a rocket launch.

Look for these beginner-friendly features:

Regulation from reputable authorities

One-click trading for clean execution

Simple stop-loss and take-profit tools

Demo account so you can practice without losing real money

Transparent fee structure (no hidden costs)

Red flags to avoid:

Brokers pushing "200% deposit bonuses" (highly likely it’s a trap)

Anyone promising guaranteed profits

Platforms encouraging you to max out your leverage

Your broker should feel boring. Professional. Stable.

That's exactly what you want.

Related Blog Post: The Best Forex Trading Brokers

2. A Free Economic Calendar (Know When NOT to Trade)

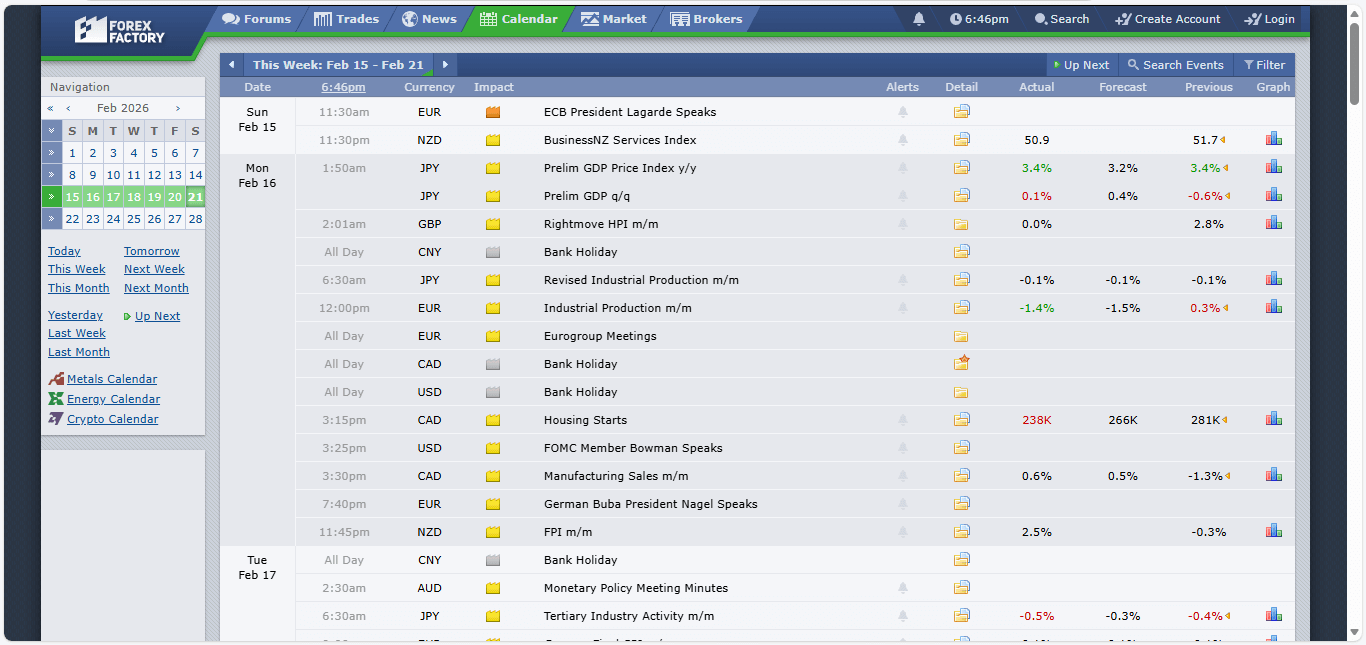

Image Source: ForexFactory Website

An economic calendar shows you when major economic events are happening. For example, interest rate decisions, employment reports, GDP releases, and inflation data.

Why does this matter for forex and stock trading?

Because markets go absolutely wild during these events.

Volatility spikes. Spreads widen. Your stop-losses get hunted and triggered. Even experienced traders often avoid trading during this period.

Trading blindly during major news releases is one of the fastest ways to blow your account as a beginner.

Free options that work perfectly:

ForexFactory economic calendar

Investing.com calendar

TradingView's built-in calendar

You don't need to predict what the news will be. You just need to know when it's happening so you can step aside.

Mark high-impact events in red. Avoid trading 30 minutes before and after.

Simple rule that saves accounts.

3. A Simple Charting Platform

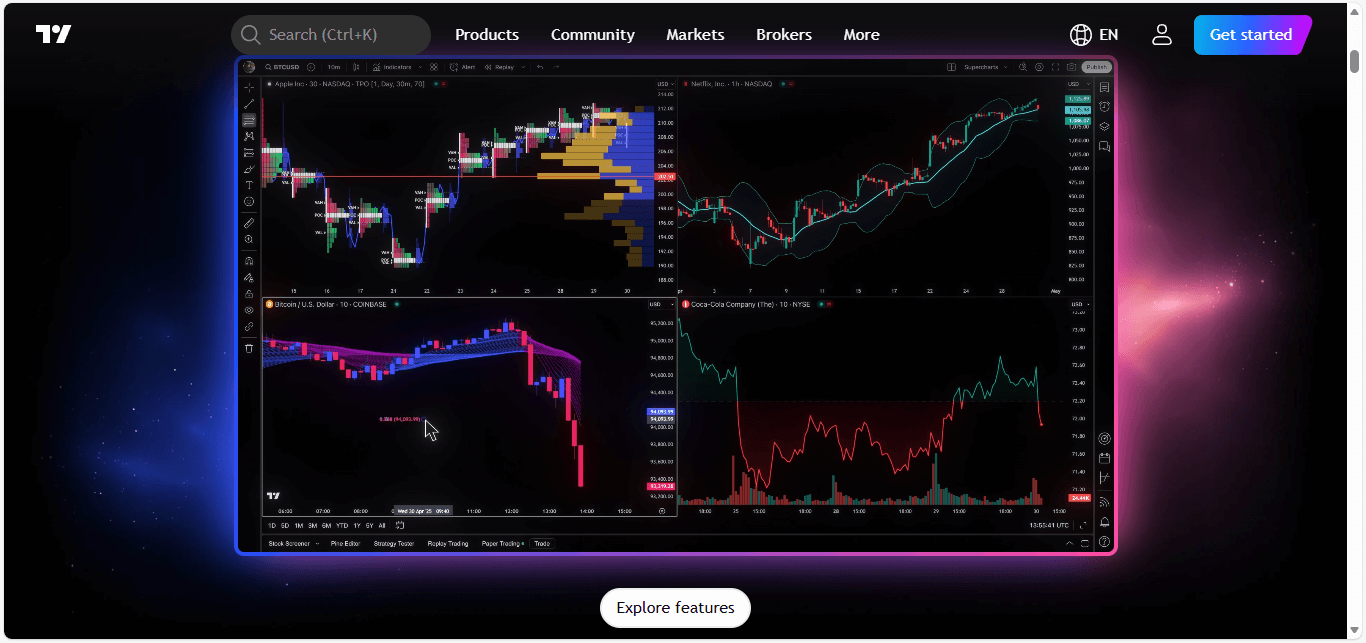

Image Source: TradingView Website

Charting software lets you see what the market is actually doing. Easily spot price movements, trends, support and resistance levels, etc.

Trading is visual. You need to clearly see where the market's been and where it might be going.

But here's the trap: overcomplicated charts destroy beginner progress.

You don't need 15 indicators fighting for space. You need clarity.

Best beginner option: TradingView

The free version gives you:

Clean, intuitive charts that don't make your eyes bleed

Drawing tools for marking levels

Common indicators (moving averages, RSI, MACD)

Multi-timeframe analysis

Price alerts (huge for discipline)

A social feed where traders share ideas

One warning about that social feed: observe, don't copy.

Use TradingView to learn how price moves, not to chase random strangers' trades. Most of those "setups" are posted after the move already happened anyway.

The free tier is more than enough for your first year of trading.

4. A Trading Journal

This is the most important tool on this entire list.

Not joking. Not exaggerating.

A trading journal records everything about your trades:

Entry and exit points

Why you took the trade

Risk percentage and position size

Screenshots of your charts

How you felt during the trade

Why does this matter?

Because a journal prevents traders from falling into random gambling. Instead, trading transforms into structured learning.

Without a journal, you're flying blind. You repeat the same mistakes. You rely on your memory (which is terrible). You can't identify patterns in your wins or losses.

With a journal, you see everything clearly:

What setups actually work for you

What mistakes you keep making

How emotions affect your decisions

When you're at your best and worst

You can journal your trades manually using:

Google Sheets, Excel or Notion

Columns for date, pair/stock, setup, risk %, profit/loss, notes

Screenshot folder on your desktop

You can also use dedicated journaling software to automate the process.

5. A Position Size Calculator

This tool calculates exactly how many lots or shares to trade based on:

Your account size

Your risk percentage (typically 1% per trade)

Your stop-loss distance

Here's the brutal truth: most beginner losses don't happen because of bad analysis.

They come from risking too much on a single trade.

You can have a great trading strategy and still blow your account if you're trading 5 lots when you should be trading 0.5.

Position size calculators remove the guesswork. They make risk mathematical instead of emotional.

Where to find one:

Built into many trading platforms

Free online calculators (just Google "position size calculator forex")

Of all the trading disciplines to learn first, position sizing matters most.

It's the difference between surviving your learning and blowing your account in three weeks.

6. Price Alerts (Trade Around Your Life)

Price alerts notify you when the market reaches a specific level you've marked.

Sounds simple, right? But this tool is massively underrated.

Benefits for beginners:

You don't need to stare at charts all day

Prevents impulsive trades based on boredom

Lets you actually live your life while waiting for setups

Builds patience (something beginners desperately need)

Instead of watching every tick, you mark your levels, set your alerts, and walk away.

When price arrives, you get notified. Then you check if the setup is still valid and decide.

How to use them:

Set alerts in TradingView

Use your broker's mobile app alerts

Mark both entry levels and invalidation levels

This tool eliminates anxiety caused by constant screen-watching and replaces it with intentional decisions.

7. Structured Education (Not Random YouTube)

You need a clear, beginner-focused learning path that teaches:

How markets actually work

Risk management fundamentals

Trading psychology

Strategy structure and testing

Why random YouTube videos destroy beginners:

Because you learn concepts in the wrong order. You get conflicting advice.

One video says "scalping is best”. The next video says "scalping is gambling”. So, you end up confused about how to proceed.

Better beginner education sources:

Babypips' School of Pipsology (completely free, incredibly structured)

Your broker's educational webinars (many are surprisingly good)

Trading psychology books like Trading in the Zone by Mark Douglas

Step-by-step blog articles.

The best education emphasises why things work, not just what to do. It focuses on risk and discipline, not Lamborghinis and lifestyle marketing.

Start with one source. Complete it fully. Then move to the next.

What Beginners DON'T Need

Knowing what to ignore is just as important as knowing what to use.

1. Expensive Signal Services and "Black Box" Systems

These are paid groups, automated bots, or EAs (Expert Advisors) promising consistent profits.

Why they're terrible for beginners:

You don't understand the logic behind the trades. You can't manage risk properly. You learn zero actual skills.

Most haven’t been properly backtested or are outright scams.

Signals teach dependency, not skill. If you can't trade manually first, automation will just make you lose money faster.

Skip them entirely.

2. Dozens of Technical Indicators

Beware of this beginner trap: overloading your charts with eight different indicators in the pursuit of certainty.

What actually happens:

Analysis paralysis. Conflicting signals. Information overload. Confusion.

You end up with a rainbow mess of lines and no idea what's actually happening.

The truth: Price structure and 1-2 simple indicators are more than enough.

Clarity beats complexity every single time.

3. Multiple Monitors and "Professional" Hardware

A single laptop is completely sufficient.

More trading screens don't equal better decisions. Professional traders care about execution, not aesthetics.

One clear chart and proper preparation are better than six monitors with no structured plan.

4. Real-Time Professional News Services

Bloomberg Terminal costs $24,000 per year. Reuters Eikon isn't much cheaper.

Do you need these as a beginner?

Absolutely not.

They're designed for institutions moving millions. Speed doesn't help if you don't have a plan.

A free economic calendar and slightly delayed data work perfectly fine for retail traders.

5. Copy Trading as a "Shortcut"

Copy trading lets you automatically mirror other traders' positions.

The risks:

You don't understand their strategy. Your risk tolerance might not match theirs. Their performance can tank suddenly.

Copy trading isn't a learning tool; it's a way to risk real money while gaining zero skill.

Hard pass for beginners.

6. VPS (Virtual Private Server)

A VPS runs your trading platform 24/7 without your computer being on.

When you need it: If you're running automated strategies that need constant uptime.

When you don't: If you're a manual beginner trader.

It's an unnecessary monthly cost at this stage. Skip it.

When Should You Upgrade Your Tools?

Upgrades should be purpose-driven, not ego-driven.

Consider upgrading when:

You've traded consistently for 6+ months

You fully understand your strategy

You can clearly explain your edge

You're profitable or breaking even

Possible upgrades at that point:

Paid journaling software with advanced analytics

Backtesting tools

VPS (only if you move to automation or trade-copiers)

Let your tools grow with your skill level, not ahead of it.

The Bottom Line: Simplicity Is Your Competitive Advantage

Beginner traders don't fail because they lack adequate tools.

They fail because:

They chase shortcuts instead of learning fundamentals

They confuse complexity with competence

They ignore risk management basics

They jump from strategy to strategy

The best traders start simple, master basics, and scale slowly.

If you build your trading foundation around clear tools, controlled risk, and continuous learning, you give yourself something most beginners never have:

Survivability.

And in trading, surviving long enough to learn is an edge that truly matters.

Ready to start trading the right way? Bookmark this guide, set up your free demo account, and commit to tracking your first 50 trades in a journal.

Trending

It's possible, even without an SSN.

Discover key qualities to consider when choosing right.

Learn what contributes to a successful business launch.

Deals & Promotions

You can also gain unlimited free access to Exclusive Content and Offers.

2026 © MitchelleO.D. All Rights Reserved.

Disclaimer: As an Amazon Associate, we earn from qualifying purchases. We may participate in additional affiliate networks or programs beyond Amazon.

Visit our Affiliate Disclosure Page to learn more.