The Best Personal Finance Tools for Managing Your Money in 2025

Disclaimer

Some links may earn us a small commission at no extra cost to you.

Click here to read our full affiliate disclosure.

Disclaimer

We believe in complete transparency with our audience.

Some links may earn us a small commission at no extra cost to you.

Please know that we only recommend products/services we have personally used, thoroughly researched, and genuinely believe can benefit our audience.

We are immensely grateful for every click and purchase you make through these links. Thank you for being a part of our community and for your continued support!

Click here to read our full affiliate disclosure.

Updated on 11/10/2025

Managing your money doesn’t need to be complicated.

Whether you’re in the United States, Africa, or anywhere else in the world, utilising the right financial tools can significantly impact your success in achieving your financial goals.

In this blog post, we will delve into the most effective personal finance tools available for budgeting, investing, and monitoring your finances across various regions.

Choosing the Best Finance Tools:

Here are the options.

You may use the buttons above to skip through to your region.

Personal Finance Tools for US Users

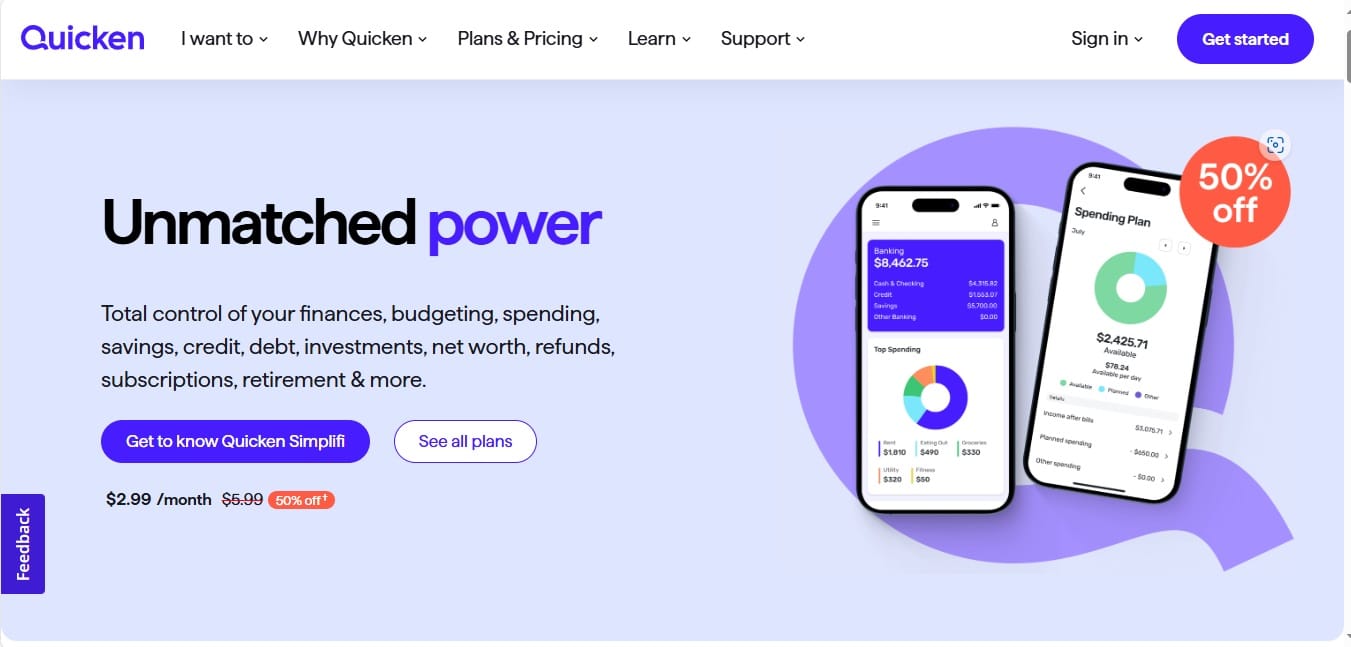

I. Quicken

Image Source: Quicken Website

Price: Starting at $35.99/year

Key Features:

All-in-one financial dashboard

Investment portfolio tracking

Bill payment management

Custom budget creation

Property management tools

Tax planning assistance

Why We Recommend It:

Quicken stands out as the most comprehensive financial management solution for US users who want a complete view of their finances in one place.

You’ll get:

Extensive Financial Overview

Quicken centralises your financial data by linking bank accounts, credit cards, loans, and investments.

This integration provides a complete view of your finances, making it easier to monitor spending and track your net worth in real-time.

Budgeting and Expense Tracking

Quicken's customisable budgeting tools stand out. Create tailored budgets based on your spending habits and receive alerts for overspending.

The software automatically categorises expenses, saving you time and helping you make informed financial decisions.

Investment Management

Monitor your investments with Quicken’s robust tracking tools. Analyse performance and understand tax implications to maximise returns while monitoring your overall financial health.

Debt Reduction Planning

Create effective debt reduction plans with Quicken. Visualise repayment schedules and set goals to manage loans more efficiently and pay them down faster.

Tax Preparation Support

Simplify tax season with Quicken’s tools that help identify potential deductions and organise necessary financial data.

Save time and ensure you don’t miss out on valuable deductions.

Accessibility and User Support

Access your financial information anytime, anywhere, with Quicken's cloud-hosted options. Plus, 24/7 customer support for quick issue resolution.

II. Credit Sesame

Image Source: Credit Sesame Website

Price: Free basic plan

Key Features:

Free credit score monitoring

Credit report access

Personalised credit improvement tips

Debt management strategies

Credit card recommendations

Why We Recommend It:

Credit Sesame’s offerings are essential for anyone looking to build or maintain their credit score.

You’ll get:

Free Credit Score Monitoring

Credit Sesame gives you free daily access to your credit score and a credit report summary.

Monitor your credit health and get alerts for any changes or suspicious activity.

Personalised Credit Improvement Tools

Utilise tailored tools that provide specific suggestions for improving your credit score.

With a "credit report card" grading key factors, you'll easily spot areas for improvement.

Identity Protection

Enjoy peace of mind with identity theft protection, including alerts for credit report changes and up to $50,000 in insurance.

Premium members can access even greater coverage against fraud.

Debt Management Features

Gain insights into your debt situation, including amounts owed and interest rates.

Credit Sesame offers smart recommendations to help you lower interest payments and pay off debts more effectively.

Rewards with Sesame Cash

The Sesame Cash account allows you to earn cashback rewards while enjoying perks like early payday and direct deposit.

Build your credit through everyday spending without the hassle of traditional credit checks.

Product Recommendations

Receive customised recommendations for loans, credit cards, and mortgages based on your financial profile.

Discover options that align with your goals and credit score.

Educational Resources

Access a wealth of educational resources, including tips for improving your credit and managing finances.

Join a supportive community to share advice and experiences.

III. Acorns

Image Source: Acorns Website

Price: Starting at $3/month

Key Features:

Automated micro-investing

Round-up investment feature

IRA retirement accounts

Checking account with debit card

Educational resources

Why We Recommend It:

Acorns makes investing accessible to everyone. It’s particularly beneficial for those who want to start investing with small amounts.

You’ll get:

Automated Micro-Investing

With Acorns' Round-Ups feature, effortlessly invest your spare change from everyday purchases.

Link your debit or credit card, and watch as transactions round up to the nearest dollar, investing the difference seamlessly.

Low Barriers to Entry

Start investing with just $5! Acorns removes minimum account balance requirements, making it easy for anyone to begin their investment journey.

Diverse Investment Options

Choose from a wide array of investment portfolios, including Exchange Traded Funds (ETFs) across various asset classes like stocks and bonds.

Whether you prefer conservative or aggressive strategies, Acorns has options, including socially responsible investments and a Bitcoin-linked ETF.

High-Interest Banking Features

Enjoy checking accounts with no overdraft fees and access to over 55,000 fee-free ATMs.

Plus, earn competitive interest rates on your checking and emergency fund accounts to maximize your savings.

Educational Resources

Boost your financial literacy with Acorns’ educational materials, including videos, tips, and live Q&A sessions with financial experts.

Grow your knowledge and make informed investment decisions.

Bonus Investment Opportunities

Earn bonus investments while shopping! With over 450 partner brands, Acorns rewards your purchases with additional funds for investing.

Tools for Financial Growth

Explore financial growth with Acorns' JobFinder tool, which helps you discover side hustles and income opportunities. Increase your earnings and invest more with ease!

Top International Personal Finance Tools

I. PocketSmith

Image Source: PocketSmith Website

Price: Free to $19.95/month

Key Features:

Multi-currency support

Long-term financial forecasting

Customisable budgeting tools

Bank feed integration

Scenario planning

Why We Recommend It:

PocketSmith is ideal for international users who need to manage multiple currencies and plan for the future.

You’ll get:

Comprehensive Financial Management

PocketSmith offers a complete financial overview, letting you track income, expenses, and investments all in one place.

Advanced Budgeting Tools

Create personalised budgets tailored to your financial goals with PocketSmith's customisable options.

Set daily or monthly budgets and monitor your progress for disciplined spending.

Long-Term Financial Forecasting

Plan for the future with PocketSmith's ability to forecast finances up to 60 years ahead.

This feature helps you prepare for major life events and retirement, ensuring informed financial choices today.

Automatic Bank Feeds and Transaction Categorisation

Simplify transaction tracking with automatic bank feeds from over 12,000 financial institutions.

PocketSmith categorises your transactions automatically, making it easy to keep an eye on your spending habits.

Scenario Testing

Use scenario testing to simulate various financial decisions and their potential outcomes.

This feature is perfect for assessing the impact of big purchases or income changes.

Shared Access

Collaborate on financial planning by sharing access to your accounts with trusted partners or advisors.

This is particularly useful for families or couples managing shared finances.

Educational Resources

Empower yourself to make informed financial decisions and understand the effects of your spending habits

II. YNAB (You Need A Budget)

Image Source: YNAB Website

Price: $14.99/month

Key Features:

Four-rule budgeting methodology

Real-time budget adjustments

Goal tracking

Debt payoff planning

Educational resources

Why We Recommend It:

YNAB's structured approach to budgeting has helped users save an average of $6,000 in their first year.

You’ll get:

Empowering Financial Control

With YNAB, assign every dollar a job to understand your spending and ensure you live within your means. This proactive approach empowers you financially.

Improved Budgeting Skills

Enhance your budgeting with YNAB's educational tools. Learn to prioritize spending for better financial habits and long-term stability.

Goal-Oriented Savings

Use YNAB to define specific savings goals—be it a vacation, a new car, or an emergency fund. Stay focused and track your progress effortlessly.

Enhanced Awareness of Spending Habits

Track and categorise your expenses in real-time with YNAB. Gain clarity on your spending habits to make informed choices and identify saving opportunities.

Flexibility in Budgeting

Adapt your budget with YNAB as your financial situation changes. Easily adjust for unexpected expenses or income fluctuations without feeling restricted.

Community Support and Resources

Access YNAB's community and educational resources, including workshops and tutorials, to enhance your budgeting strategies and financial planning.

Significant Savings Potential

Many users report saving significantly—averaging $600 in the first two months and up to $6,000 in the first year. Experience the impact of better savings on your financial health!

Image Source: eToro Website

Price: $0 commission on stocks, $500 minimum for Smart Portfolios

Key Features:

Smart Portfolios managed by experts

Copy trading functionality

Diverse asset classes including stocks, ETFs, currencies, commodities, and crypto

Zero management fees on portfolios

User-friendly interface

Educational content

Mobile app access

Why We Recommend It:

eToro is transforming investing with its innovative Smart Portfolios and social trading features.

This platform is unique by providing professionally managed, themed investment portfolios without requiring any management fees, ensuring that sophisticated investing is within reach for all individuals.

With a minimum investment of just $500 for Smart Portfolios, users can tap into diversified investment strategies that typically demand significantly higher capital.

Smart Portfolio Features:

Pre-built portfolios based on specific themes (e.g., renewable energy, AI, cybersecurity)

Professional management by eToro's investment team

Automatic rebalancing to maintain optimal allocation

Transparent performance tracking

Diversification across multiple asset classes

No additional management fees or hidden costs

Essential Financial Tools for African Users

I. PocketSmith

Image Source: PocketSmith Website

Price: Free to $19.95/month

Key Features:

African bank integration

Multi-currency tracking

Flexible budgeting tools

Cash flow forecasting

Custom categories

Why We Recommend It:

PocketSmith's robust currency management features make it especially valuable for African users managing multiple currencies and variable income streams.

You’ll get:

Comprehensive Financial Management

PocketSmith offers a complete financial overview, letting you track income, expenses, and investments all in one place.

Advanced Budgeting Tools

Create personalised budgets tailored to your financial goals with PocketSmith's customisable options.

Set daily or monthly budgets and monitor your progress for disciplined spending.

Long-Term Financial Forecasting

Plan for the future with PocketSmith's ability to forecast finances up to 60 years ahead.

This feature helps you prepare for major life events and retirement, ensuring informed financial choices today.

Automatic Bank Feeds and Transaction Categorisation

Simplify transaction tracking with automatic bank feeds from over 12,000 financial institutions.

PocketSmith categorises your transactions automatically, making it easy to keep an eye on your spending habits.

Scenario Testing

Use scenario testing to simulate various financial decisions and their potential outcomes.

This feature is perfect for assessing the impact of big purchases or income changes.

Shared Access

Collaborate on financial planning by sharing access to your accounts with trusted partners or advisors.

This is particularly useful for families or couples managing shared finances.

Educational Resources

Empower yourself to make informed financial decisions and understand the effects of your spending habits

II. eToro

Image Source: eToro Website

Price: $0 commission on stocks, $500 minimum for Smart Portfolios

Key Features:

Expert-managed Smart Portfolios

Diverse investment themes and strategies

Zero management fees

Multi-asset diversification

Copy successful investors

Mobile trading capabilities

Educational resources and market analysis

Why We Recommend It:

eToro's Smart Portfolios offer African investors an opportunity to engage with professionally managed investment strategies while avoiding the steep fees often associated with traditional wealth management services.

With themed portfolios, investors can strategically align their investments with particular market trends or sectors.

Additionally, the copy trading feature empowers them to automatically replicate the strategies of successful investors, enhancing their investment journey.

Portfolio Management Benefits for African Investors:

Access to global investment themes and strategies

Professional portfolio management without fees

Automatic diversification across multiple assets

Regular portfolio rebalancing

Market insights and analysis

Risk management through diversification

Ability to track and copy successful investors

Final Thoughts

Selecting the right personal finance tool is essential for achieving your financial goals.

Whether you're in the USA, Africa, or anywhere else in the world, there's a solution tailored to your requirements.

Start with a tool that tackles your most urgent financial issue, and as your needs evolve, expand your toolkit accordingly.

Keep in mind that the most effective personal finance tool is the one you will use regularly.

Make the most of free trials when they’re available, and don’t hesitate to change tools if your current choice isn’t fulfilling your expectations.

Trending

It's possible, even without an SSN.

Discover key qualities to consider when choosing right.

Learn what contributes to a successful business launch.

Deals & Promotions

You can also gain unlimited free access to Exclusive Content and Offers.

2026 © MitchelleO.D. All Rights Reserved.

Disclaimer: As an Amazon Associate, we earn from qualifying purchases. We may participate in additional affiliate networks or programs beyond Amazon.

Visit our Affiliate Disclosure Page to learn more.